A solid understanding of basic accounting concepts serves as an essential foundation, especially when you want to pursue Accountancy in college and related courses. As we know, Accounting serves as the language of business, which enables organizations to record, summarize, and interpret financial transactions. Through this, it facilitates informed decision-making.

Through experience, I laid out and explained the fundamental concepts such as debit, credit, drawings account, expenses, assets, liabilities, equity, and revenue. At the end of this article, you are expected to have an understanding of such things. Lastly, you will be given some tips on how to remember and understand by heart these fundamental concepts because it is important to know them by heart, not just in mind, so that it will be easier for you to solve a similar problem to it next time.

Unlock the PDF by Sharing 🔐

Click the buttons below to share this content on Pinterest, Twitter, or Facebook and unlock the PDF download link.

PDF Download: Download PDF

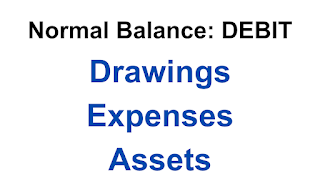

Debit

In accounting, the term "debit" is the term used for an entry made on the left side of a financial account. It indicates an increase in:

- Drawings

- Expenses

- Assets

Credit

Meanwhile, "credit" is the term used for an entry made on the right side of a financial account. It signifies an increase in:

- Liabilities

- Equity

- Revenue

Drawings Account

An account that is used to record the withdrawal of assets or funds from a business by the owner(s) for personal use.

Example: The owner withdraws money or other assets from the company.

The drawings account is debited. On the other hand, the cash account is credited. This entry reduces the owner's equity in the business. This reflects the resources that have been taken out for specific purpose.

Expenses

It encompasses the costs incurred by a business in its operations to generate revenue. These are outflows of economic resources. Common examples are payments for supplies, utilities, salaries, and rent.

Expenses are typically debited in accounting records, as they decrease the owner's equity or increase liabilities, reducing the overall profitability of the organization.

Assets

It encompasses tangible and intangible resources owned or controlled by a business which provide future economic benefits. This includes cash, receivables, inventory, property, plant and equipment, goodwill, among others. Assets are recorded on the left side of the balance sheet and are debited when increased or credited when decreased.

Liabilities

Liabilities represent the obligations or debts owed by an organization to external parties. They can include accounts payable, notes payable, accrued expenses, among others. Liabilities are recorded on the right side of the balance sheet and are credited when increased or debited when decreased.

Equity

Equity, also known as net assets or shareholders' equity, represents the residual interest in the assets of an entity after deducting liabilities. It typically includes contributed capital, retained earnings, and other components that reflect the accumulated gains or losses of the business. Equity is credited when increased or debited when decreased, reflecting the impact on the ownership stake in the organization.

Revenue

Revenue refers to the inflow of economic benefits resulting from the sale of goods, provision of services, or other activities from the entity's operations. Note that it is recognized when it is earned, regardless of when payment is received (accrual). It increases the owner's equity or decreases liabilities and is credited in accounting records, reflecting the impact on the organization's financial performance.

Here is what you need to remember: DEA | LER

Drawings, Expenses, and Assets are always debited when increased. They are only credited when decreased.

Liabilities, Equity, and Revenue are always credited when increased, and debited when decreased.

By now, it is hoped that you better understand this topic. Should you want to master these fundamentals of accounting, including debit, credit, drawings account, expenses, assets, liabilities, equity, and revenue, don't just memorize or familiarize. Understand it by heart, and you'll surely know what to do even if the economic transactions are presented differently.

Remember to share it with others. Together, let us make learning fun.

Senior High School Notes